Markets in Perspective

S&P 500

2008 - March 2019

This chart shows the growth of $10,000 based on S&P 500 Index performance over the last several years. Although past performance is no guarantee of future results, we believe looking at the market’s overall resiliency through several major crises and events helps to gain a fresh perspective on the benefits of investing for the long-term.

THE AVERAGE ANNUAL TOTAL RETURN OF THE S&P 500 INDEX FOR THE PERIOD SHOWN BELOW WAS 6.98%.

See Disclaimers - Source 1

Staying the Course

Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to solve one problem, it creates several others:

When do you get back in? You must make two correct decisions back-to-back; when to get out and when to get back in.

By going to the sidelines you may be missing a potential rebound. This is not historically unprecedented; see chart below

By going to the sidelines you could be not only missing a potential rebound, but all the potential growth on that money going forward. We believe the wiser course of action is to review your plan with your advisor and from there, decide if any action is indeed necessary. This placates the natural desire to “do something”, but helps keep emotions in check.

INTRA-YEAR DECLINES VS. CALENDAR YEAR RETURNS

Volatility is not a recent phenomenon. Each year, one can expect the market to experience a significant correction, which for the S&P 500 has averaged approximately 14% since 1980. Although past performance is no guarantee of future results, history has shown that those who chose to stay the course were rewarded for their patience more often than not.

See Disclaimers - Source 2

History of US Bear & Bull Markets

1926- March 31, 2020

See Disclaimers - Source 3

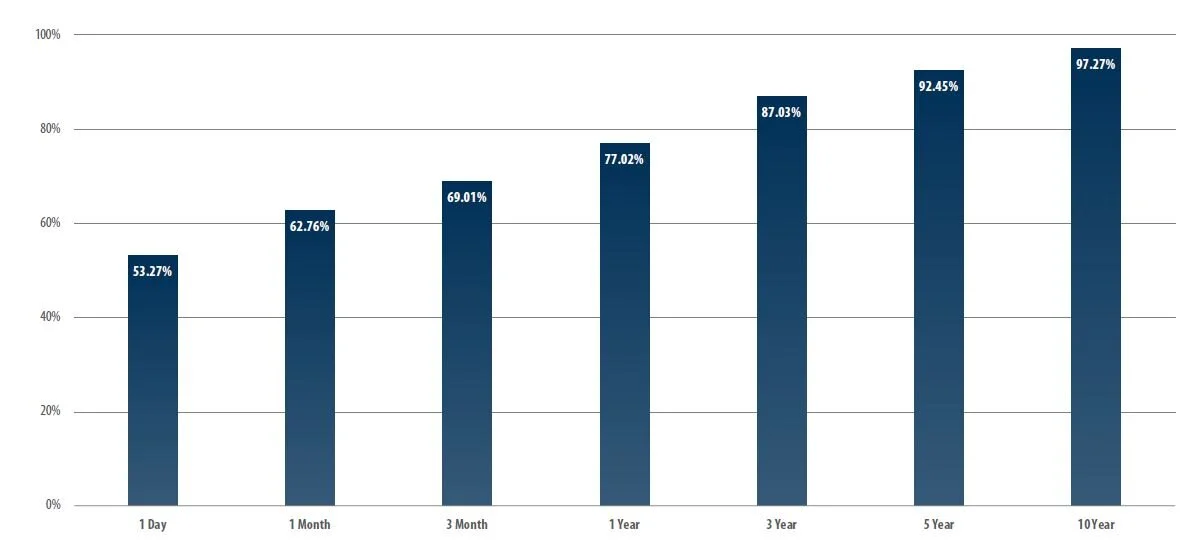

Probability of Positive Returns

S&P 500 Index: 1037-March 31,2020

Investing in the stock market can be volatile. For this reason, we believe it is important to keep proper perspective when stocks rise or fall over short periods of time. History has shown that the odds of achieving a positive return are dramatically increased the longer the investment horizon.

See Disclaimers - Source 4

S&P 500 Index

Performance After Its Worst Days

See Disclaimers - Source 5

A History of Market Corrections

Investors like to avoid stock market declines at all costs, but declines are an inevitable part of Investing. A little historical background can help put stock market declines in perspective.

See Disclaimers - Source 6

DISCLAIMERS

Source 1 : Bloomberg, First Trust Advisors L.P., 1/1/08 - 3/31/20. Past performance is no guarantee of future results. This chart is for illustrative purposes only and not indicative of any actual investment. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Stocks are not guaranteed and have been more volatile than the other asset classes. These returns were the result of certain market factors and events which may not be repeated in the future.

Source 2 : Bloomberg, First Trust Advisors L.P., as of 3/31/20. The benchmark used for the above chart is the S&P 500 Index. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Returns are based on price only and do not include dividends. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future. Past performance is no guarantee of future results.

Source 3 : First Trust Advisors L.P., Bloomberg. Month-end returns from 1926 - 3/31/2020. *Not applicable since duration is less than one year. Past performance is no guarantee of future results. These results are based on monthly returns–returns using different periods would produce different results. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future. Past performance is no guarantee of future results. This chart is for illustrative purposes only and not indicative of any actual investment. The illustration excludes the effects of taxes and brokerage commissions or other expenses incurred when investing. These returns were the result of certain market factors and events which may not be repeated in the future. This chart is based on the total returns of the S&P 500 Index. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. The index cannot be purchased directly by investors.

Source 4 : Bloomberg, 1937 through 3/31/2020. Past performance is no guarantee of future results. This chart is for illustrative purposes only and not indicative of any actual investment. The illustration excludes the effects of taxes and brokerage commissions or other expenses incurred when investing. These returns were the result of certain market factors and events which may not be repeated in the future. This chart is based on the total returns of the S&P 500 Index. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. The index cannot be purchased directly by investors.

Source 5 : Bloomberg. Performance is price return only (no dividends). As of 3/31/20. Past performance is no guarantee of future results. The charts are for illustrative purposes only and not indicative of any actual investment. Returns are average annualized returns, except those for periods of less than one year, which are cumulative. Index returns do not reflect any fees, expenses, or sales charges. Stocks are not guaranteed and have been more volatile than the other asset classes. These returns were the result of certain market factors and events which may not be repeated in the future. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index.

Source 6 : Bloomberg. As of 3/31/20. Past performance is no guarantee of future results. For illustrative purposes only and not indicative of any actual investment. Investors cannot invest directly in an index. *Assumes a 50% recovery rate of lost value. **Measures from the date of the market high to the date of the market low. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. The Dow Jones Industrial Average® (The Dow®), is a price-weighted measure of 30 U.S. blue-chip companies. The index covers all industries except transportation and utilities.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial advisors are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.